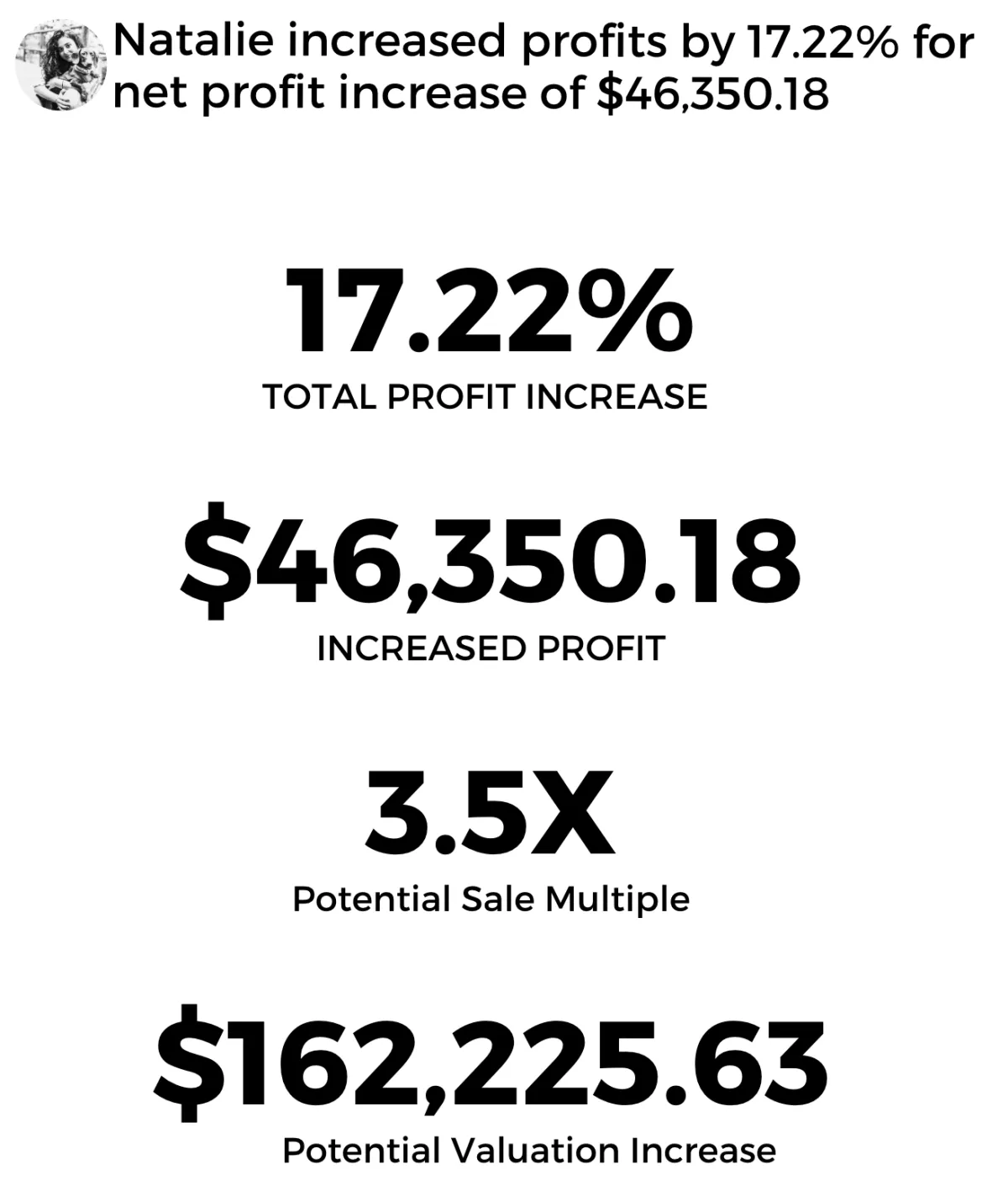

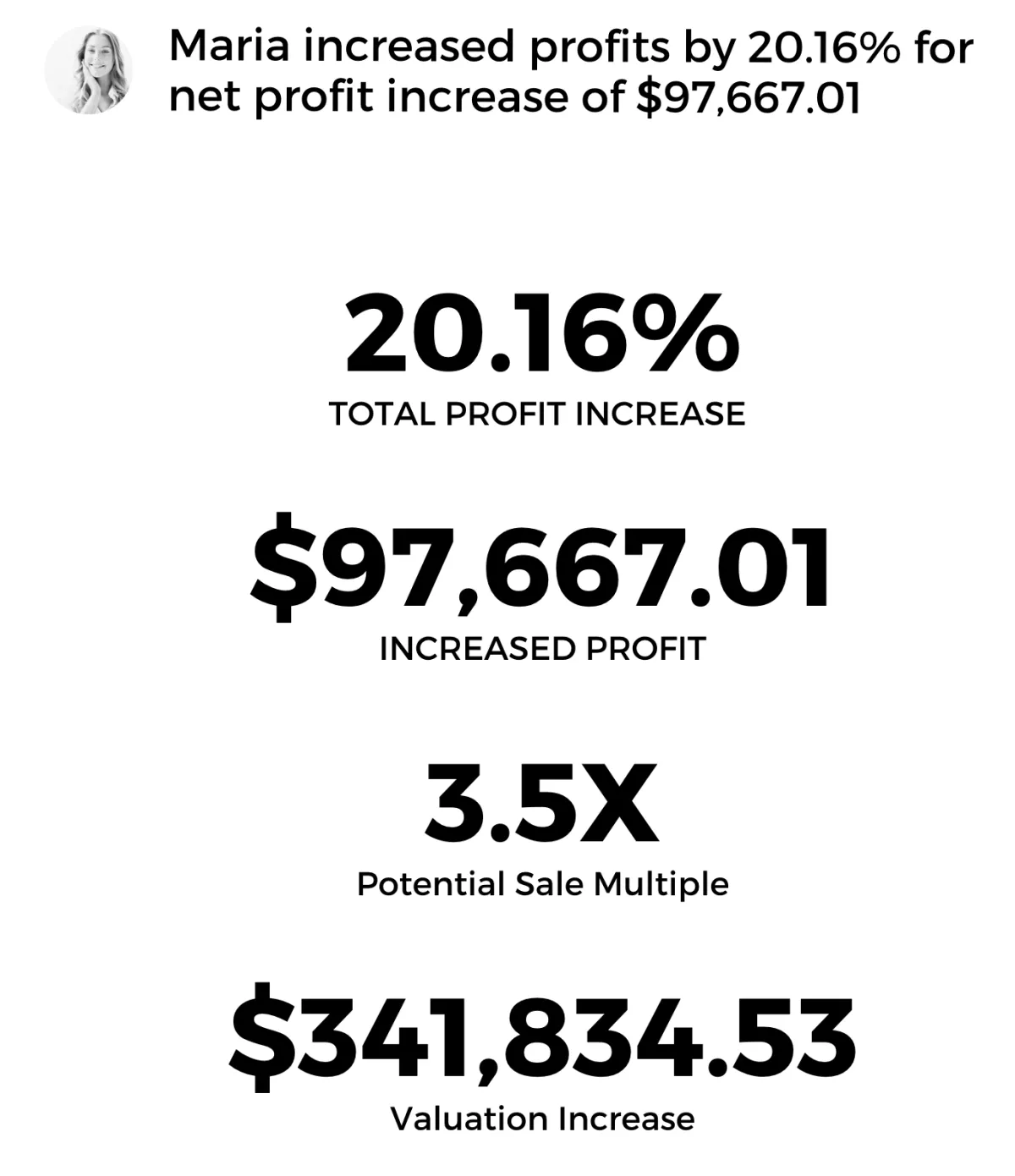

Unlock 15%+ More Profit with Our FREE Video Guide 🎥 – Discover Proven Strategies to Maximize Your Business’s Profit Potential Today

The Proven Blueprint Anyone Can Follow to Build a Profitable, Scalable Business.

Unlock real profit with The Proven Profit Plan—designed for serious eCommerce sellers who want clarity, control, and a business built to sell. Serious question: How much profit are you losing without even knowing it?

"Our biggest win after working with SellerVue"

Our biggest win after working with SellerVue has been being able to make smarter decisions based on the accurate information. We are planning to sell our business next year, so there’s a huge weight lifted off my shoulders knowing that we are in a great position to maximise cashflow and increase our valuation.

Chloe Morgan

AMAZON PRIVATE LABEL SELLER

"They found an extra $35,000 in profit."

My Broker referred me to SellerVue, as my per SKU unit costs were an absolute mess. Literally within days all my costs were perfectly organised and they found an extra $35,000 in profit. That is an extra $131,250 on my business valuation. Very unexpected. I'm super impressed.

Tony Madden

FBA & SHOPIFY SELLER

"I didn't realize how much money I was losing!"

All I can say is that I wish we had found out about SellerVue years ago. My accountant & bookkeeper say they can't live without them (and me too). I didn't realize how much money I was leaving on the table until I started working with them, they're an incredible asset to my business.

Rachel Rose

FBA & SHOPIFY SELLER

"It’s made my life so much easier!"

The best thing is that I'm no longer getting emails from my Accountant and Bookkeeper asking me to up date my product unit costs. They can literally just go get it themselves. Plus, I know everything is accurate and up-to-date without the back-and-forth.Now that is a win!

Beth Anderson

FBA & ETSY SELLER

Amazon, Shopify, ETSY, WALMART, EBAY, TIKTOK...

Systemize Profit.

Stop the Leaks.

Start Building Real Profit.

If You’re Not Tracking It, You’re Losing It. Learn How to Recover Hidden Profit—Fast.

You’re Probably Bleeding Profit and Don’t Even Know It.

Freight charges not hitting your P&L correctly.

You’re booking the shipment, but the real landed costs aren’t flowing through to your product margins—leaving you with distorted profit reports and false confidence.

Supplier costs quietly creeping up.

Your unit prices increase in small steps over time, invoices shift, and you miss the micro-changes that silently erode your margins month after month.

Hidden fees and adjustments slipping by.

Payment processor fees, storage surcharges, ad platform adjustments, and small penalties stack up quietly—leaking cash while you’re focused elsewhere.

Tariffs, customs, and duties misapplied or unaccounted for.

These charges can significantly impact your true landed cost, but they often get lumped into general expenses or missed entirely—putting your margin calculations at serious risk.

Incorrect cost allocations across SKUs.

Shipping, freight, and transaction fees get applied unevenly or generically across product lines—distorting your SKU-level profitability and hiding your real winners and losers.

Spreadsheet errors driving bad decisions.

Manual data entry, broken formulas, version control issues—these mistakes quietly skew your profit reports and lead you to scale products that are actually losing money.

If you’re not tracking it, you’re paying for it.

If you’re not systemizing it, you’re losing it.

WHO IS THIS FOR

Systemize Profit Across Every SKU—Automatically.

If You’re Not Tracking It, You’re Losing It. Learn How to Recover Hidden Profit—Fast.

Track True Landed Costs

Supplier Costs, Freight Fees, Customs and Duties are automatically tracked per SKU. No more guesswork.

Uncover Hidden Profit Leaks

Expose the silent fees, unnoticed charges, and rising costs quietly eating your margins. No more assumptions—just complete visibility.

Make Profit-First Decisions

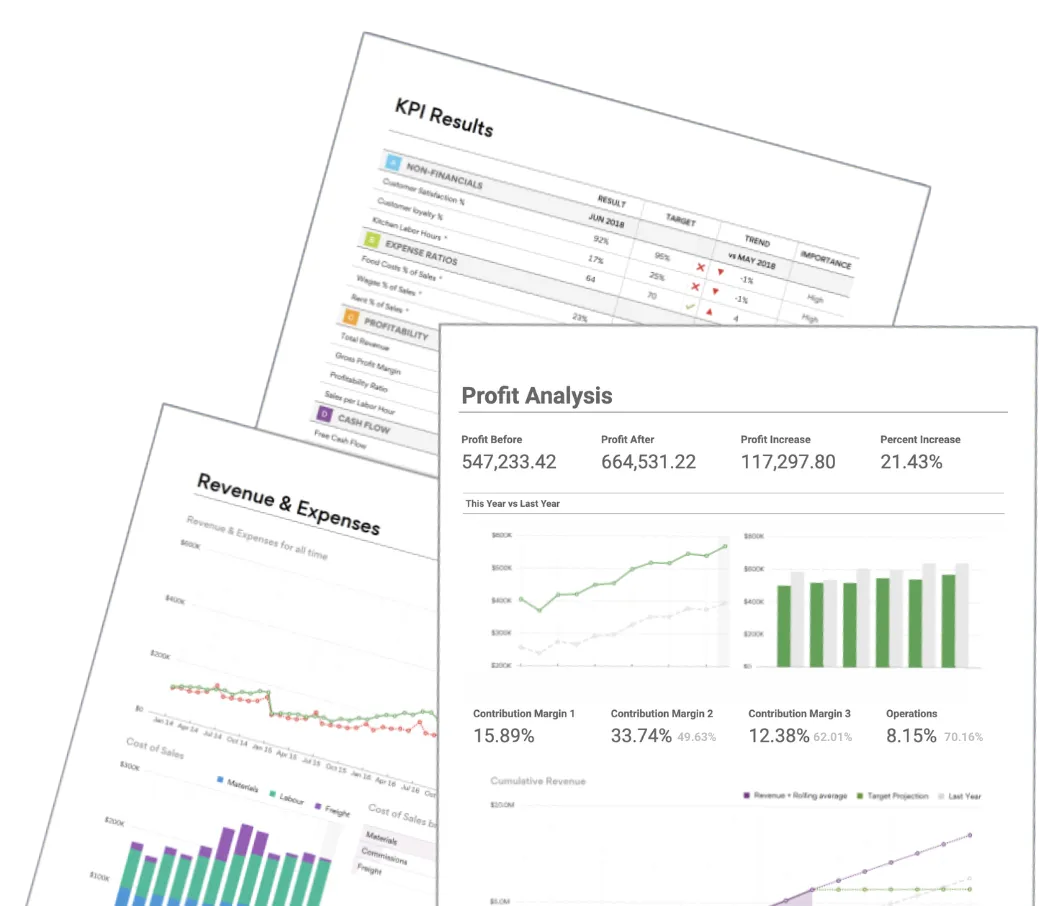

Live dashboards and weekly scorecards keep your team aligned and focused on what actually drives margin.

Build a Business That’s Profitable

Stop relying on spreadsheets. Build smart systems that grow with you and don’t collapse under pressure.

Learn Our S.C.A.L.E. Framework

Systemize

Profit

Track true per-SKU profitability—COGS, refunds, fees, freight, duties, and hidden costs. What you don’t measure, you can’t fix.

Control

Inventory

Prevent stockouts, overstock, and profit loss with precise forecasting, landed costs, and disciplined reorder management.

Assign Accountability

Build clear SOPs, and team scorecards. When everything is yours, nothing gets done well. Shared accountability drives performance and results.

Leverage

Metrics

Track the KPIs that drive profit and accurate weekly scorecards.

If your numbers aren’t right, your decisions and your profit will suffer.

Exit the

Weeds

Whether scaling or preparing to sell, build a business that doesn’t depend on you. Step back. Be the owner, not the operator.

Implement our For Proven Profit Plan That Transforms Businesses… And Boosts Profit by 15% or More.

In 2016, our founder, Mark Botha, was running successful eCommerce businesses—but he knew more profit was being left on the table. After years of optimizing operations and recovering hidden costs, he built a system that changed everything.

By 2020, that system freed up over $115,000 in cash flow and added $375,000 to his business valuation. In 2021, Mark launched the SellerVue S.C.A.L.E Framework to help other sellers unlock hidden profits, boost margins, and build truly scalable businesses.

We help eCommerce sellers like you recover profit, optimize supply chains, and unlock up to 15% or more in hidden gains—just like Mark did.

BUILT BY SELLERS, FOR SELLERS

SellerVue vs. Your (Ineffective) Spreadsheet. There’s simply too much margin for error, misinterpretation and you simply cannot scale a business from a spreadsheet. We know, because we already tried. It’s the reason we ended up building SellerVue in the first place.

Life Before

Hidden costs that eat into profits.

Supply chain inefficiencies slowing growth.

Revenue trap holding back profitability.

Lack of clarity on business performance.

Tracking irrelevant or unhelpful KPIs.

Life After

Optimized costs, maximizing profit potential.

Streamlined supply chain driving faster growth.

Revenue unlocked through smart strategies.

Clear and actionable business insights.

Focused on the KPIs that matter most.

The Hard Truth: Your Business Isn’t Ready—Yet

Let’s be real. Scaling an eCommerce store isn’t just about more sales. It’s about profits that stick, systems that run themselves, and a strategy that makes buyers fight to own your business.

Without the right plan:

Hidden inefficiencies bleed your profits dry.

Cash flow stalls when you need it most.

Growth feels like a gamble.

And an exit? A distant fantasy

But it doesn’t have to be that way. Our Proven Profit Plan hands you the exact playbook used by top sellers to dominate their markets then exit their business easily. No fluff. No guesswork. Just results.

Stop Guessing. Start Winning.

Scale Your Ecommerce Business to Millions—and Exit on Your Terms for More!

Are you stuck in the daily grind of running your ecommerce business? Overwhelmed by inventory headaches, unpredictable cash flow, and stalled growth? Maybe you’ve dreamed of cashing out with a 7- or 8-figure exit—but it feels out of reach.

You’re not alone. Most ecommerce sellers never break free from the chaos. They stay trapped, working harder for less, while others scale smart, sell big, and walk away with life-changing payouts.

What’s the difference? A proven roadmap.

Discover Proven Strategies to Maximize Your Business’s Profit Potential Today—the ultimate step-by-step video that takes you from scrambling to scaling, then straight to a profitable exit. Whether you’re bootstrapping or ready to cash out, this is your blueprint to build a business that thrives—and sells for millions.

.

Strategies That Actually Drive Profit.

The Proven Profit Plan unlocks hidden profit, stops silent leaks, and streamlines your supply chain—fast.

No guesswork. No spreadsheets that lie.

Just clear, profit-first insights you can trust. With built-in automation, your business keeps running smoothly while you scale. More profit. Less friction. Real control.

A System for Scaling to Unmatched Profits.

When you lock in the Proven Profit Plan, your business doesn’t just run—it scales on autopilot. You grow faster, protect profit, and control the game. Five figures? That’s your baseline. Six figures? We’ve done it. Seven? That’s where we’re taking you.

Sometimes, it’s as small as an $0.18 difference in landed cost per unit. Sounds minor—until you multiply it by 22,000 units over 12 months, across 45 SKUs. That tiny leak silently drained one seller’s margins—it added up to $97,000 in lost profit.

SellerVue found it. SellerVue fixed it. They got it back.

So, What IS the Proven Profit Plan?

The Proven Profit Plan is a comprehensive solution designed to optimize your eCommerce business for maximum profit. It uncovers hidden costs, streamlines your operations, and implements data-driven strategies to recover lost profit—all on autopilot.

Set it up once, and it works in the background, ensuring your business runs efficiently and profitably. Powered by proven financial and supply chain optimization principles, it delivers the right insights, at the right time, to help you maximize your margins and scale with confidence.

The Clock’s Ticking.

Every day you wait is a day your business leaks profits, misses growth, and drifts further from that big exit. Take control now. Scale smart. Exit rich.

"Our biggest win after working with SellerVue"

Our biggest win after working with SellerVue has been being able to make smarter decisions based on the accurate information. We are planning to sell our business next year, so there’s a huge weight lifted off my shoulders knowing that we are in a great position to maximise cashflow and increase our valuation.

Chloe Morgan

AMAZON PRIVATE LABEL SELLER

"They found an extra $35,000 in profit."

My Broker referred me to SellerVue, as my per SKU unit costs were an absolute mess. Literally within days all my costs were perfectly organised and they found an extra $35,000 in profit. That is an extra $131,250 on my business valuation. Very unexpected. I'm super impressed.

Tony Madden

FBA & SHOPIFY SELLER

"I didn't realize how much money I was losing!"

All I can say is that I wish we had found out about SellerVue years ago. My accountant & bookkeeper say they can't live without them (and me too). I didn't realize how much money I was leaving on the table until I started working with them, they're an incredible asset to my business.

Rachel Rose

FBA & SHOPIFY SELLER

"It’s made my life so much easier!"

The best thing is that I'm no longer getting emails from my Accountant and Bookkeeper asking me to up date my product unit costs. They can literally just go get it themselves. Plus, I know everything is accurate and up-to-date without the back-and-forth.Now that is a win!

Beth Anderson

FBA & ETSY SELLER

What the Perfect Profit System IS NOT

Typical Profit Optimization Tools

Traditional tools just don’t cut it. They leave you guessing on where profits are leaking, and often rely on outdated methods that don’t deliver real results.

Unpredictable Quick-Fix Solutions

It’s risky and inefficient to rely on one-off tactics that promise massive returns without addressing the core issues holding your business back.

Manual, Time-Consuming Processes

Endless hours spent analyzing, adjusting, and manually tweaking your numbers doesn’t make you more profitable—it drains your time and energy.

Gimmicky Marketing Trends

Tired of chasing the latest "get-rich-quick" strategies that don’t deliver long-term results? The Perfect Profit System is built on proven, sustainable optimization strategies—no fads, just real growth.

SellerVue is a data-driven platform for eCommerce sellers that delivers real-time insights to optimize supply chain operations and drive profitability.

Have A Tremendously Profitable Day.

Copyright 2025. SellerVue SEZC. All Rights Reserved. Terms of Service / Privacy Policy / Refund Policy / Affiliate Disclaimer / Earnings Disclaimer