New Feature: Use SellerVue to automatically update your A2X Google Sheet... Read the Article 🚀

How Maria Recovered $97,667.01 on Her P&L Just in Time for Valuation?

Learn how Maria strategically identified and reclaimed $97,667.01 on her P&L, enhancing her profitability and significantly increasing her business's valuation just in time for a crucial assessment. Her approach offers valuable insights for any business owner looking to maximize their financial standing before a valuation.

3.4%

Profit Margin Increase

$97,667.01

Increased Profit

3.5x

Potential Sales Multiple

$347,834.53

Potential Valuation Increase

The Challenge

Maria, a successful business owner, was preparing to sell her company and was aiming to maximize its valuation. However, she faced a significant challenge: she needed to have a clear and precise understanding of her costs. Without knowing exactly what her cost per unit was and the lead times involved, she was unsure whether she was leaving money on the table. Maria recognized that having a detailed breakdown of her costs was crucial for negotiating a better sale price, but she was unsure where to start.

Our Approach

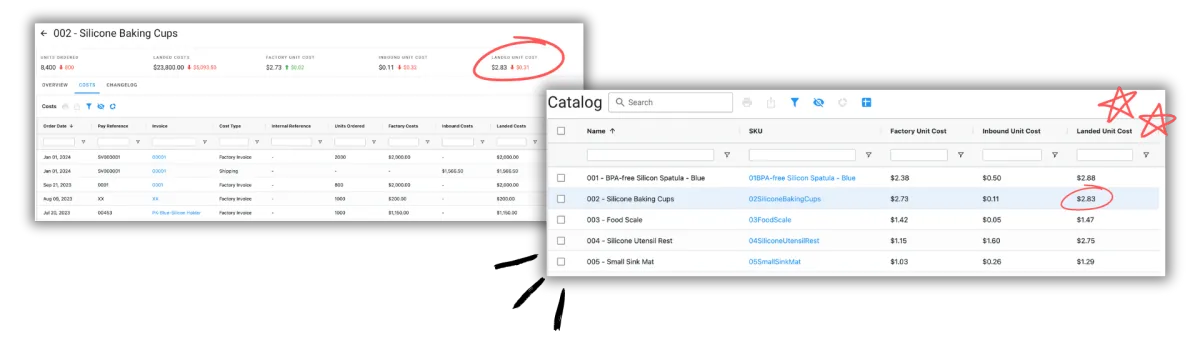

To address Maria's challenge, we began by conducting a thorough analysis of her business's cost structure. Our primary focus was to determine the exact cost per unit, starting by understanding the last received cost for each product. We did this by carefully reviewing factory invoices, shipping bills, and customs documentation. Ensuring accuracy in these areas was crucial, as any oversight could significantly impact the true cost of goods sold.

One of the key steps in our approach was to remove any non-recurring items from the cost calculations, allowing us to establish a clean and accurate Cost Per Unit. This provided Maria with a clear picture of her ongoing expenses and helped to identify any hidden costs that could be reduced or eliminated.

Additionally, our audit extended to shipping and Harmonized System (HS) codes assessments to ensure that the correct duty rates were being applied. By verifying these details, we ensured Maria wasn’t overpaying on import duties, which can quietly erode profit margins.

With a precise understanding of her costs, we then focused on streamlining her processes. This included negotiating better terms with suppliers, optimizing lead times to reduce holding costs, and improving operational efficiency. We also explored opportunities for cost savings by renegotiating contracts and investigating alternative suppliers and freight forwarders, ensuring Maria was receiving the best possible rates and service levels.

The Outcome

The results were impressive. By implementing the cost-saving strategies identified during our analysis, Maria was able to increase her profit by $97,667.01. This represented a 3.40% improvement in her profit margin, a significant achievement in a relatively short period.

But the benefits didn’t stop there. With a 3.5x multiple applied to her enhanced profitability, Maria’s business valuation increased by an additional $347,834.53. This substantial boost in value came just in time for her crucial business assessment, positioning her for a much more favorable sale.

The Takeaway

Maria's experience underscores the importance of understanding the intricacies of your cost structure, especially when preparing for a business sale. By taking the time to identify cost-saving opportunities and streamline operations, Maria not only reclaimed nearly $100,000 in her Profit & Loss statement but also significantly increased the overall value of her business.

For any business owner looking to maximize their financial standing before a valuation, Maria's approach offers valuable insights. It highlights how strategic cost analysis and operational improvements can lead to substantial gains, not only in profitability but also in the overall worth of a business. Whether you're planning to sell your business or simply aiming to enhance its financial health, a thorough understanding of your costs is essential to unlocking hidden value.

How COGS Tracking works

Get better clarity into your COGS

With SellerVue, you have everything your business needs to stay organized all in one central place, without multiple spreadsheets. Using the Invoice Manager, you can store digital copies of supplier and shipping invoices, and keep supplier contact information at your fingertips.

Calculate what your business could be losing annually without accurate cost management.

WHO IS THIS FOR

SHOPIFY, AMAZON, ETSY, WALMART, EBAY, TIKTOK...

Powerful Features to Optimize Costs, Streamline Operations, and Maximize Profitability

📄 Create a Purchase Order

Streamline Your Procurement Process Effortlessly initiate your purchasing journey by creating a detailed purchase order (PO). Our platform helps you specify quantities, product details, and supplier information for a smooth start.

🧾 Receive the Invoice

Stay Organized with Automated Invoicing After confirming your purchase order, receive and manage your supplier’s invoice. Easily keep track of invoices and documents to avoid payment delays and streamline accounting.

💸 Invoice Paid

Simplify Your Payments Quickly and efficiently process invoice payments, keeping your cash flow in check and your suppliers satisfied. Track every transaction in one place.

🏭 Production Begins

Kickstart Production with Confidence Once your payment is made, production begins. Our system ensures that materials and schedules are aligned for a smooth manufacturing process.

✅ Production Complete

Celebrate Milestones with Completed Production Once production is complete, you will be notified. Stay informed throughout the process to ensure all timelines and quality standards are met.

⏳ Production Lead Time Captured

Production Lead Time Captured ⏳ Analyze and Optimize Lead Times Automatically capture production lead times to help improve planning. Use our analytics to assess production efficiency and enhance scheduling for future orders.

📊 Total Lead Time of Goods

Gain Insights into Total Lead Time Monitor the total lead time from production to delivery. Our system captures data at each stage, enabling you to identify bottlenecks and optimize operations for faster delivery.

🚚 Create a Shipment Plan

Plan Shipments with Precision Easily create a shipment plan tailored to your needs. Coordinate with shipping providers and track shipments at every stage to ensure timely delivery.

📩 Request a Quote

Get Competitive Shipping Quotes Request quotes from multiple shipping carriers directly through our platform. Compare options side-by-side to find the best rates for your shipment.

📦 Select Shipping Carrier

Choose the Best Shipping Partner Select the optimal carrier based on cost, delivery speed, and reliability. Our system helps you make informed decisions to reduce shipping costs and ensure on-time delivery.

🌍 Goods in Transit

Track Your Shipments in Real-Time Stay updated on your goods’ journey with real-time tracking. Know exactly where your shipment is at any given time and when it will arrive.

💳 Receive and Pay the Shipping Invoice

Streamline Shipping Payments Once the goods are delivered, receive and pay the shipping invoice effortlessly. Keep all shipping costs organized and ensure prompt payments for smoother logistics.

📥 Goods Received

Confirm Receipt of Goods When your goods arrive, promptly confirm their receipt. Our system logs the details to ensure inventory is updated, preventing discrepancies.

📦 Goods Added to Inventory

Enhance Inventory Management Easily add received goods to your inventory. Accurate inventory management helps you keep track of stock levels, preventing stockouts or overstocking.

📊 Stock Values Calculated (FIFO)

Optimize Your Inventory Valuation Use the First In, First Out (FIFO) method to calculate stock values. Our platform ensures accurate financial reporting and effective inventory management.

"Our biggest win after working with SellerVue"

Our biggest win after working with SellerVue has been being able to make smarter decisions based on the accurate information. We are planning to sell our business next year, so there’s a huge weight lifted off my shoulders knowing that we are in a great position to maximise cashflow and increase our valuation.

Chloe Morgan

AMAZON PRIVATE LABEL SELLER

"They found an extra $35,000 in profit."

My Broker referred me to SellerVue, as my per SKU unit costs were an absolute mess. Literally within days all my costs were perfectly organised and they found an extra $35,000 in profit. That is an extra $131,250 on my business valuation. Very unexpected. I'm super impressed.

Tony Madden

FBA & SHOPIFY SELLER

"I didn't realize how much money I was losing!"

All I can say is that I wish we had found out about SellerVue years ago. My accountant & bookkeeper say they can't live without them (and me too). I didn't realize how much money I was leaving on the table until I started working with them, they're an incredible asset to my business.

Rachel Rose

FBA & SHOPIFY SELLER

"It’s made my life so much easier!"

The best thing is that I'm no longer getting emails from my Accountant and Bookkeeper asking me to up date my product unit costs. They can literally just go get it themselves. Plus, I know everything is accurate and up-to-date without the back-and-forth.Now that is a win!

Beth Anderson

FBA & ETSY SELLER

"Profitability is increasing the gap between revenue and expenses. A well-managed supply chain not only

reduces costs but also ensures timely deliveries, minimizes waste,

and maximizes margins."

Who's it for?

Our solution is perfect for sellers looking to optimize cash flow with efficient supply chain management and accountants needing precise data for streamlined financial reporting.

Turn Paperwork Into Profit

Maximize your margins, minimize your effort with precise ecommerce cost accounting.

Automated cost calculations

Cloud based data

Real time & accurate cost per units

Fast and efficient automated solution

Save hours on your monthly bookkeeping

I'm a Seller...

As an e-commerce seller, the time you spend on bookkeeping could be more effectively utilized for adding new products instead.

I'm an Accountant...

As an accountant, precision is paramount. However, tracking sellers’ cost data can often be a laborious task, with no guarantee of its accuracy.

SellerVue is a supply chain management software for eCommerce sellers. It streamlines purchase orders, tracks costs, manages shipments, and uncovers hidden expenses to boost profitability. By automating calculations and providing real-time insights, SellerVue helps sellers and accountants optimize operations and drive business growth.

COMPANY

RESOURCES

Copyright 2025. SellerVue SEZC. All Rights Reserved. Terms / Privacy / Refund Policy

Have A Tremendously Profitable Day.